The copper industry is working to ensure environmentally responsible practices and clean-energy technologies are at the heart of the copper value chain. This idea drew industry experts, market analysts and ICA members to the Copper Demand and Sustainability Workshop on the eve of London Metal Exchange (LME) Week.

In the words of Eduardo Mencarini, Partner at McKinsey, during the event, “From renewable energy infrastructure to electric vehicles, the transition to net zero cannot happen without copper.” However, the metal alone cannot be the solution.

In front of a room full of analysts, journalists and members of the copper industry at the Hyatt Regency Hotel—The Churchill in London, Colin Hamilton, Managing Director of Commodities Research at BMO Capital Markets, moderated two panel sessions that explored the decarbonization challenge, demand projection, responsible production frameworks and supply chain collaboration.

Former ICA Chairman, Stephen Higgins of Freeport-McMoRan, gave the opening remarks.

Copper Industry 2030

The first panel featured Eduardo Mencarini, Partner at McKinsey, and Louise Assem, Global Director of Material Stewardship at ICA, who discussed the outlook of the copper industry for 2030 and the decarbonization challenge.

The session started with Louise announcing the release of a greenhouse gas (GHG) measurement guide to help unify carbon footprint measurements for copper production. As a first step for more unified reporting, this vital work provides the first sector-specific methodology for determining the carbon footprint of sites producing copper and copper-containing products.

Louise noted, the “guide is just one step in discussing the decarbonization challenge and the ways the copper industry can work together to harmonize greenhouse gas measurement and reporting.” This new guide is indicative of the importance of transparent reporting in responsible production and the growing mandate of consumers, businesses and governments for sustainable products.

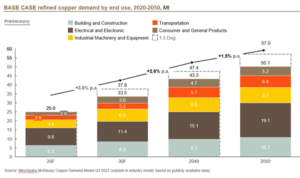

Looking downstream, Eduardo, a specialist in mining and metals, shared McKinsey’s expectation that copper demand will “grow at 3 percent per year for the next 10 years, driven by electrification, infrastructure, industrial output and a growing middle class.”

In the workshop, Eduardo spoke about the demands of the green transition driving copper demand, including renewable energy technologies, green building infrastructure, and e-mobility. He also noted the role of copper in industrial electro-processing and motor systems, as well as its contributions to the electricity grid in underground cables, transformers, batteries and offshore grids.

With a growing population and the sustainable development of emerging economies, copper demand will continue to be an enabler of green technologies.

Colin Hamilton moderated the discussion between Dr. Louise Assem and Eduardo Mencarini.

Together, Louise and Eduardo’s comments highlight where copper needs to focus over the remainder of the decade—environmentally conscious production of a metal in high demand. Copper will play a critical role not only in the development of emerging economies, but in the energy transitions of developed economies as well. This places an even greater emphasis to the importance of being able to source copper responsibly and sustainably.

Responsible Production Frameworks

The workshop’s second session featured three experts discussing the need to develop sector-specific production frameworks across supply chains. The LME’s Chief Sustainability Officer, Georgina Hallett, outlined why “responsible production frameworks are essential to industry and will play a critical role in helping the copper industry deliver its decarbonization ambitions.” Georgina shared that 75 percent of LME’s copper brands are using a Track A standard to meet the LME’s responsible sourcing requirements—clear evidence of the industry’s ambition. The remaining challenge is to create uniformity in reporting that is not only accessible to the industry’s biggest players but to any business that is producing copper and copper-containing products.

Georgina Hallett discusses responsible production frameworks.

Following Georgina, Michèle Brülhart, Executive Director of the Copper Mark, spoke about the balance between meeting ESG goals and advancing industry practices. As individual actors lead efforts to meet ESG goals, the overall performance of the industry continues to grow as the baseline for progress rises. Using the example of The Copper Mark—an independent third-party assurance framework for responsible production practices—Michèle explained why standards “enable sites throughout the copper and wider transition minerals sector to contribute positively to the communities and environments within and around which they operate.”

Andrea Mungai, a sustainability specialist at Enel Green Power, noted that it will take greater collaboration in the supply chain to decrease complexity and increase transparency. A lack of data sharing is one barrier to net zero that faces complex supply chains with numerous verticals. In his view, mitigating the environmental and social impacts of raw material use in manufacturing equipment is a strategic need that can only be addressed by “increasing the sustainability of operations.” Through partnership and transparency in the supply chain, the copper industry can continue to mitigate climate change through its impacts on UN SDGS 7, 9, 11 and 13.

Colin Hamilton moderated the second session discussion with speakers Michèle Brülhart and Andrea Mungai.

Asia World Copper Conference in Singapore

Thanks to those who attended ICA’s Copper Demand and Sustainability Workshop and to the panelists for sharing their insights and outlooks for the future.

Up next, ICA will be a silver sponsor at the Asia World Copper Conference in Singapore on 23 Novembre, where industry experts will continue the discussion on decarbonization and responsible production in the copper industry.

Thank you to all who joined!