🇪🇺 Europe needs a strong industrial policy 🏭

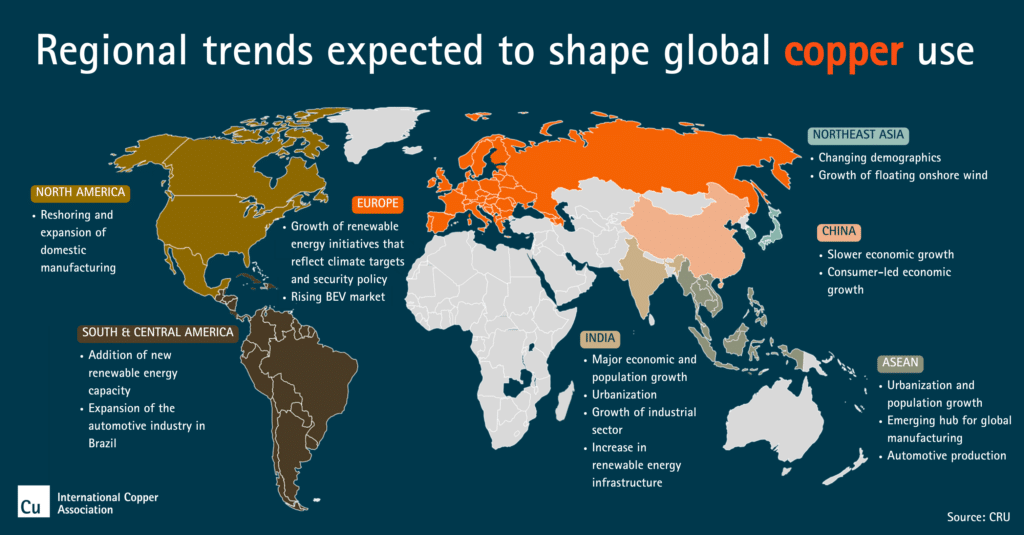

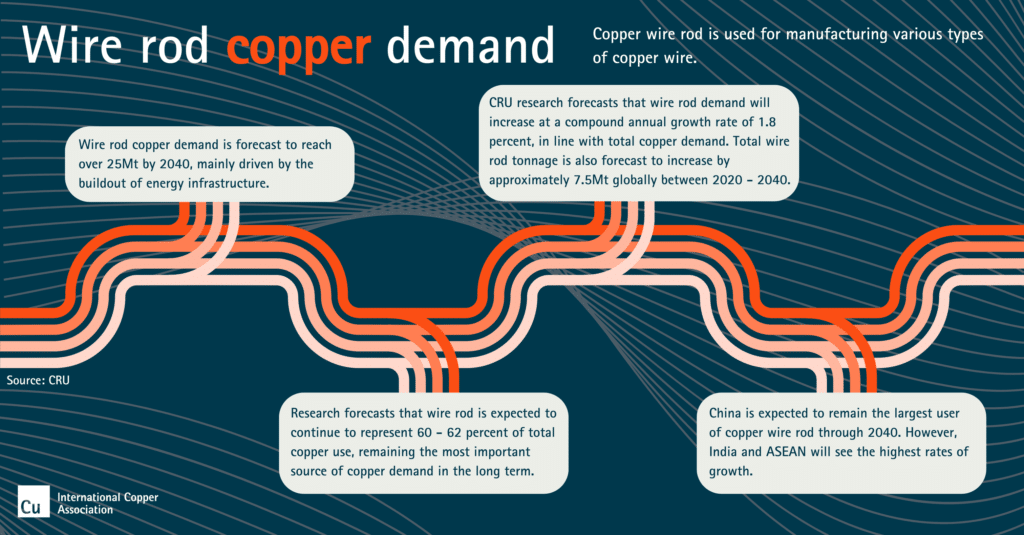

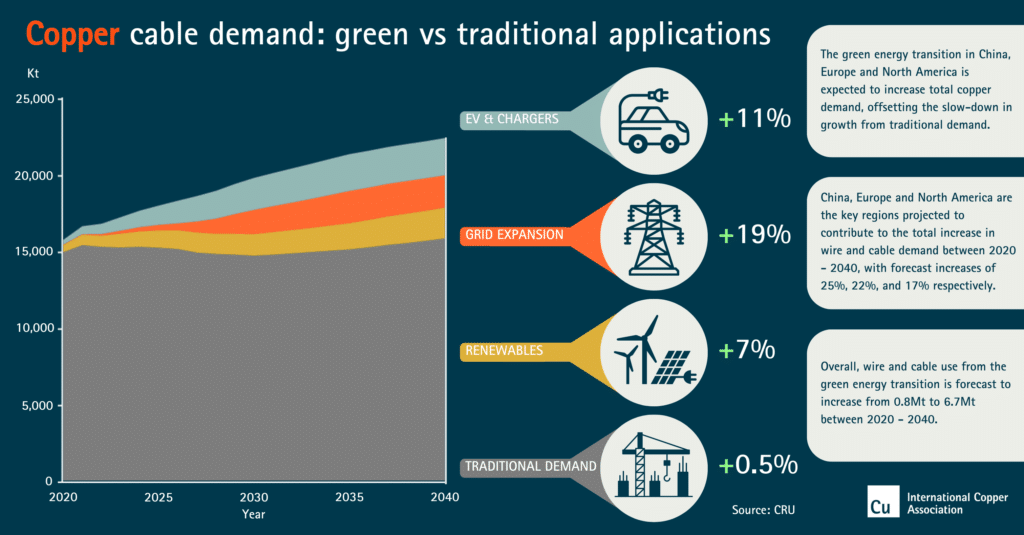

This industrial policy should address strategic net-zero value chains, from raw materials like copper to clean technologies like wind, solar, and heat pumps. It should facilitate the right conditions for investing in strategic raw materials needed to deliver a climate-neutral and resilient Europe.

ICA Europe members are committed to delivering more copper mining, copper recycling and copper refining capacity in Europe and abroad in order to deliver the copper needed for the energy transition.

For this to happen, we have identified five key proposals for the next EU Commission and EU Parliament. These proposals relate to the industrial policy, the regulatory environment, the implementation of the Critical Raw Materials Act, the access to energy, and the market outlook for clean technologies.

About ICA Europe

Based in Brussels, the International Copper Association (ICA) Europe is the leading advocate for the copper industry in Europe. As ICA’s European branch, the organisation represents companies that mine, smelt and recycle copper for use across the economy, in the electricity system, buildings, transport and industry. Through a team of policy, industry and scientific experts, ICA Europe promotes copper as an essential material for achieving the EU’s ambition of a resilient, climate-neutral Europe and seeks to ensure that EU policies enable the sustainable production of copper to serve Europe’s future needs.

Contact: Ignacio Gentiluomo, ignacio.gentiluomo@internationalcopper.org, +32 490 42 84 63

innovations in mining and processing technologies have enabled ICA members to increase productivity and mining efficiencies, extending the lifetime of existing mines. This extension of mine life decreases the energy required for exploration and development of new sites.

innovations in mining and processing technologies have enabled ICA members to increase productivity and mining efficiencies, extending the lifetime of existing mines. This extension of mine life decreases the energy required for exploration and development of new sites. For example, recycling HDPE pipes, which are used extensively for moving secondary materials in mine production, is a common practice in circular mining. Downcycling, another circular mining practice, can reduce waste by adding recycled copper scrap from fabrication back into the refining process. Many resources can be recovered during the production process and repurposed for use across industries. This is referred to as industrial symbiosis and can include recovery of iron silicate, a byproduct from processing copper slag, into a marketable product for construction and building materials. This lessens landfilling and reduces GHG emissions for the companies utilizing this product, as production does not require additional energy. To learn more about industrial symbiosis and how it contributes to the circular economy, click

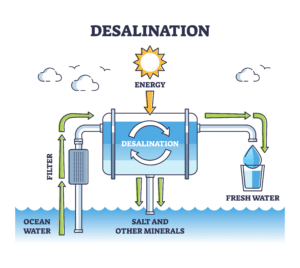

For example, recycling HDPE pipes, which are used extensively for moving secondary materials in mine production, is a common practice in circular mining. Downcycling, another circular mining practice, can reduce waste by adding recycled copper scrap from fabrication back into the refining process. Many resources can be recovered during the production process and repurposed for use across industries. This is referred to as industrial symbiosis and can include recovery of iron silicate, a byproduct from processing copper slag, into a marketable product for construction and building materials. This lessens landfilling and reduces GHG emissions for the companies utilizing this product, as production does not require additional energy. To learn more about industrial symbiosis and how it contributes to the circular economy, click  The entire copper production process employs water. An increase in water stress poses a potential challenge for the industry. Water does not need to be potable for copper production, but there are limits to the levels of particulate matter in the production process.

The entire copper production process employs water. An increase in water stress poses a potential challenge for the industry. Water does not need to be potable for copper production, but there are limits to the levels of particulate matter in the production process.  technologies to improve and expand access to freshwater. Producing copper responsibly requires a wholistic approach, addressing the key drivers of environmental impact by decreasing energy use and emissions, reducing waste and utilizing natural resources efficiently in cooperation with local communities. As the copper industry works to meet the growing needs of the clean energy transition, ICA members are striving to serve as responsible stewards of both the material and the environment.

technologies to improve and expand access to freshwater. Producing copper responsibly requires a wholistic approach, addressing the key drivers of environmental impact by decreasing energy use and emissions, reducing waste and utilizing natural resources efficiently in cooperation with local communities. As the copper industry works to meet the growing needs of the clean energy transition, ICA members are striving to serve as responsible stewards of both the material and the environment.