Future copper market share will be heavily shaped by regional responses to the global shift to a low-carbon economy.

This was the focus of ICA’s “Future Market Share” panel, which drew on two pieces of ICA-commissioned research (Copper: A Long-term View of Demand and Competitive Market Share authored by CRU and Copper Use, Substitution, and Market Share authored by DMM Advisory Group). Moderated by Ernest Scheyder, Senior Mining and Future Energy Correspondent at Reuters, the panel presented a compelling discussion to a room full of analysts, journalists and members of the copper industry at the CRU World Copper Conference 2024, part of CESCO week, in Santiago, Chile.

The CRU research demonstrates that global copper demand is forecast to grow from 28.3 million tonnes (Mt) in 2020 to 40.9Mt in 2040 with a Compound Annual Growth Rate (“CAGR”) of 1.85 percent. This growth is anticipated to come from traditional demand sectors as well as from new sectors driven by the green energy transition, such as growth in electric vehicle adoption, renewable energy integration, and grid infrastructure expansion and maintenance.

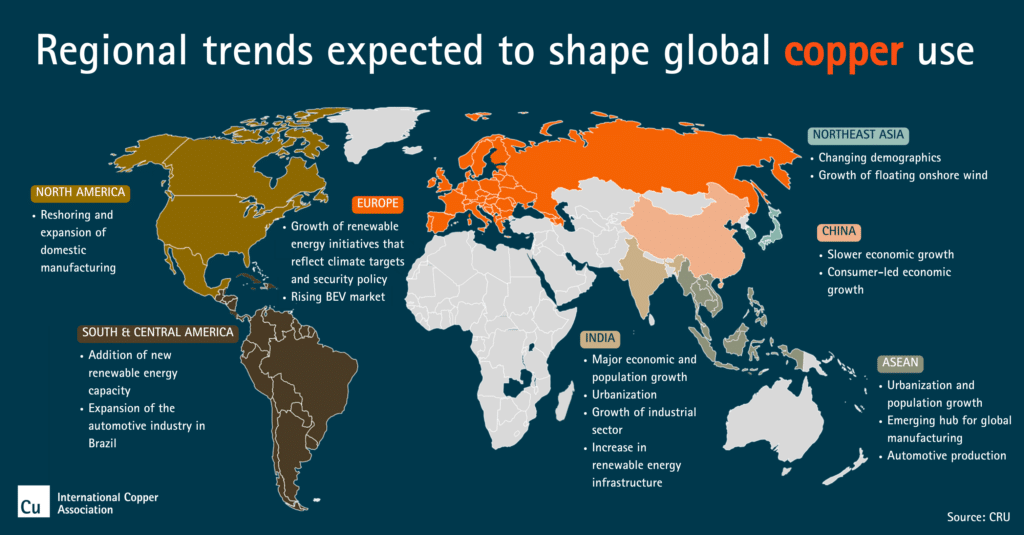

Speaking on the regional variation in copper demand, panelist Juan Brihet, CRU Senior Consultant, remarked that “while demand is expected to grow across all regions globally over the forecast time horizon, there are disparities in growth across different regions.” This was echoed by Charlie Murrah, Executive Vice President/Chief Supply Chain Officer of Southwire Co., who asserted that “copper and aluminum demand is often driven by the regional macro-economic environment. The supply of the natural resources needed to satisfy demand is often disjointed.” This regional variation is outlined in the CRU study, which identifies major growth for copper demand in India, with a CAGR of 7 percent, closely followed by the ASEAN region with forecast growth of 6 percent. While these regions are expected to lead the way, CRU projects demand growth will reach 3 percent in North America, 2 percent in South America and less than 1 percent in both China and Europe.

Various geopolitical, economic and demographic factors are driving these regional differences in copper demand. The research explored these macro trends:

As identified by the CRU research, regional responses to the vast requirements of the green energy transition are a significant contributing factor to copper use trends across the world.

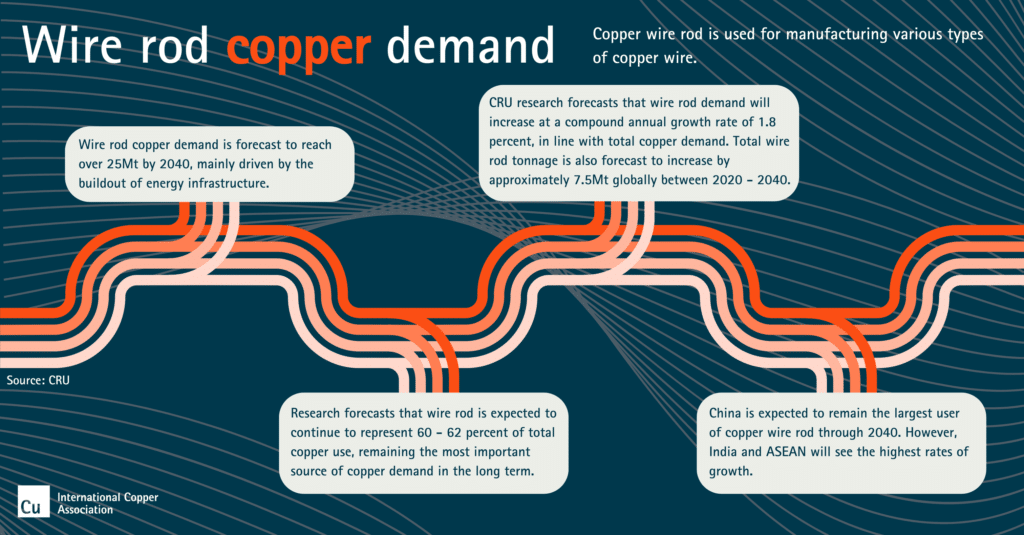

This is, arguably, best exemplified by wire rod, which is the principal application for copper, constituting an expected ~60 percent of total demand share over the long term. Wire rod copper demand is expected to reach over 25Mt by 2040, predominately driven by the buildout of energy infrastructure.

As global regions build out their energy infrastructure, wire rod demand will increase at a CAGR of 1.8 percent, in line with total copper demand, according to the CRU research. Total wire rod tonnage will also increase by approximately 7.5Mt globally between 2020 – 2040. Copper wire rod is used for manufacturing various types of copper wire, which ensures that it is a central part of power transmission, electrical components, cable constructions and other industrial applications.

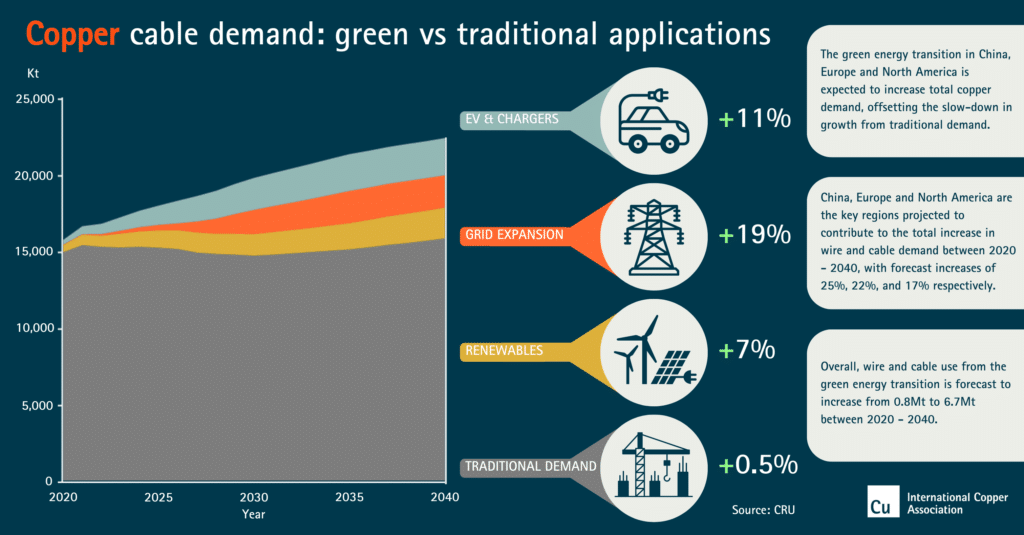

The CRU research shows that a similar trend emerges for copper cable demand, with green-related applications offsetting the slower growth rate from traditional demand areas. While copper demand in traditional applications is only projected to increase by 0.5 percent, copper is expected to see an 11 percent demand growth from EVs and chargers, a 19 percent growth from grid expansion and a 7 percent growth from renewable energy technologies. Overall, wire and cable use related to the green energy transition is expected to increase from 0.8Mt to 6.7Mt between 2020 – 2040.

While “the green energy transition supports most of the global copper demand in the long term,” according to Brihet, copper substitution with aluminum remains a risk. DMM Advisory Group’s research centers on this, with panelist Krisztina Kalman-Schueler, DMM Advisory Group Managing Partner, asserting that “in 2023, net substitution constituted 1.45 percent of copper use or 1.8 percent of copper use including miniaturization.”

The DMM Advisory Group research outlines that, although emerging applications present an opportunity for copper to grow its market share, there is potential for key copper applications to be at risk of substitution. The panel identified heat pumps as an important emerging application for copper. Heat pump demand is expected to grow, reflecting the observed trend of green applications driving increases in copper use. As Brihet asserted, “CRU expects annual heat pump sales to quadruple by 2040, going from sales of 13 million units to 52 million units between 2020 to 2040.” Kalman-Schueler also remarked on this growth potential, commenting that “heat pumps are an example of a growing energy transition market and are an energy-efficient, low-carbon, low-cost heating solution.”

If global copper markets can effectively meet these growth requirements, future copper market share will remain positive, driven by the green energy transition and regional demand trends.